Take some time, have a cuppa and explore how salary packaging could save you money and pay less tax.

Salary packaging is a way to make your income go further by potentially reducing how much tax you pay.

To sign up, you need your payslip handy. To get started, click the button below.

How salary packaging works

Salary packaging is a workplace benefit that allows you to pay for certain expenses before tax is taken out of your salary, rather than after. This could reduce your taxable income and potentially help you pay less tax each year.

How much could you save in tax?

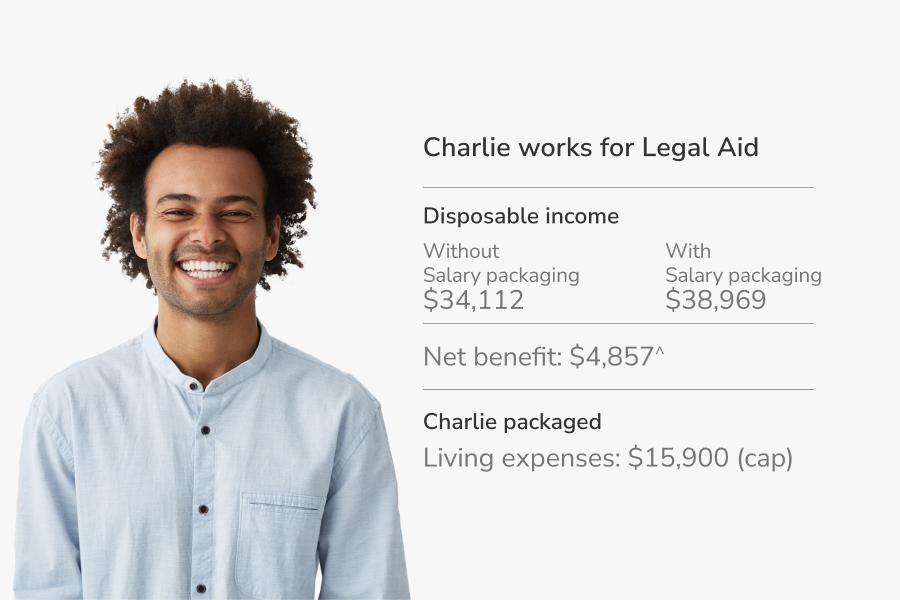

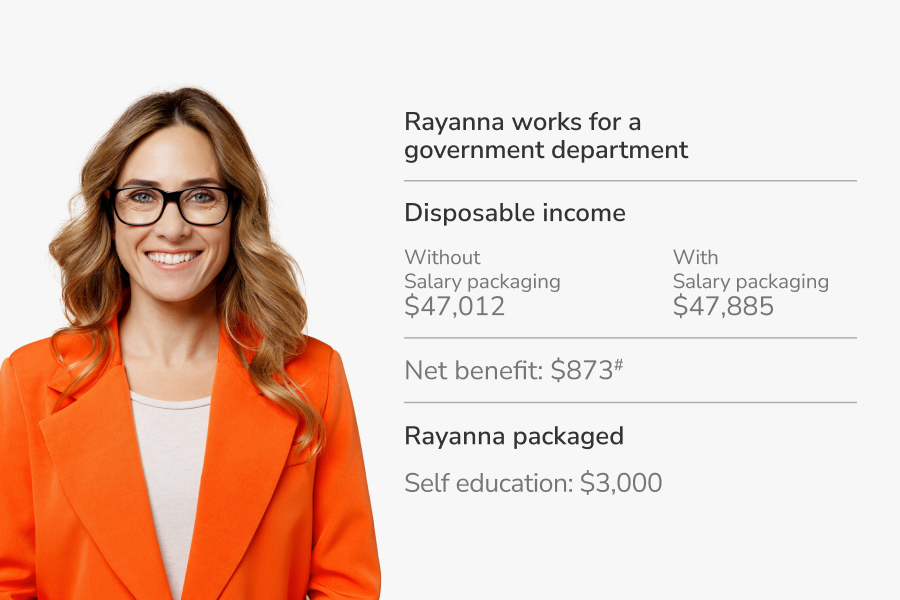

This can depend on the industry you work in, but to give you a better idea, we’ve provided three examples below from three different sectors, all earning $60k a year. There’s also a handy calculator to generate estimated tax savings based on your circumstances.

See how salary packaging could provide you with tax-saving opportunities

*Estimate only: Not financial advice. Tax outcomes will vary based on individual circumstances.

^Estimate only: Not financial advice. Tax outcomes will vary based on individual circumstances.

#Estimate only: Not financial advice. Tax outcomes will vary based on individual circumstances.

What can you salary package?

From day-to-day expenses such as your laptop to covering your home loan or rental payments, there are a wide range of benefits you may be able to package—depending on your role and industry. Select your sector below to discover what benefits you can package.

- Private health and fitness centre memberships

- Child care fees

- Home mortgage and rental payments

- Private travel

- Home mortgage and rental payments

- Utilities like phone, electricity and gas

- Portable electronic devices for work

- Professional development expenses

- Airport lounge

See our videos to learn more about how salary packaging could save you tax.

Salary packaging explained for legal aid workers

Salary packaging explained for healthcare workers

Salary packaging explained for corporate, government and educational workers

Signing up online to salary package with RemServ

Can I salary package with a HECS-HELP debt?

Having a HECS-HELP debt doesn’t prevent you from salary packaging, and it could provide you with tax savings opportunities while continuing to pay down your debt more efficiently.

Ready to start salary packaging?

To get started, have your latest payslip handy, click below and follow the prompts.

*Heath: The estimated potential tax benefit is based on the assumption that an eligible employee with an annual salary of $60,000 salary packages the $9,010 per annum limit. FBT rates effective 1 April 2024 and PAYG tax effective 1 July 2024 have been used and average Fees and Charges are included. The actual administration fee that applies to you may vary depending on your employer. Tax, benefit and Medicare Levy calculations are approximate, and assume no other taxable income is received. HELP repayments and taxation surcharges are excluded. This general information doesn’t take your personal circumstances into account.

^Charlie:The estimated potential tax benefit is based on the assumption that an eligible employee with an annual salary of $60,000 salary packages the $15,900 per annum limit. FBT rates effective 1 April 2024 and PAYG tax effective 1 July 2024 have been used and average Fees and Charges are included. The actual administration fee that applies to you may vary depending on your employer. Tax, benefit and Medicare Levy calculations are approximate, and assume no other taxable income is received. HELP repayments and taxation surcharges are excluded. This general information doesn’t take your personal circumstances into account.

#Rayanna: The estimated potential tax benefit is based on the assumption that an eligible employee with an annual salary of $60,000 salary packages $3,000 per annum. FBT rates effective 1 April 2024 and PAYG tax effective 1 July 2024 have been used and average Fees and Charges are included. The actual administration fee that applies to you may vary depending on your employer. Tax, benefit and Medicare Levy calculations are approximate, and assume no other taxable income is received. HELP repayments and taxation surcharges are excluded.

Important Information: Salary packaging is only available to eligible employees of the Queensland Government as per the Standing Offer Arrangement QGP0065-21. The implications of salary packaging for you (including tax savings and impacts on benefits, surcharges, levies and/or other entitlements) will depend on your individual circumstances. The information in this publication has been prepared by RemServ for general information purposes only, without taking into consideration any individual circumstances. RemServ and the Queensland Government recommend that before acting on any information or entering into a salary packaging arrangement and/or a participation agreement with your employer, you should consider your objectives, financial situation and needs, and, take the appropriate legal, financial or other professional advice based upon your own particular circumstances. You should also read the Salary Packaging Participation Agreement and the relevant Queensland Government Salary Packaging Information Booklets and Fact Forms available via the Queensland Government Arrangements Directory. The Queensland Government strongly recommends that you obtain independent financial advice prior to entering into, or changing the terms of, a salary packaging arrangement.