There’s a super way you could be making your money work for you.

Did you know you could be eligible to salary package your default and any additional voluntary superannuation contributions, potentially saving on tax while still growing your nest egg?

Typically, Queensland Government employees have their default superannuation contribution set at 5% of their salary, whilst employer paid contributions are set at 12.75%. These numbers differ for Queensland Police staff; refer to the Superannuation Information Booklet for more information.

With RemServ, a trusted name in salary packaging and proud to be part of the Queensland Government panel of providers for more than 20 years now, the 5% (or other selected default contribution percentage) would be deducted from your salary before income tax is applied – meaning that you could pay less tax! And if you wish to further increase your retirement fund, you can choose to make voluntary super contributions in addition to your default contribution amount.

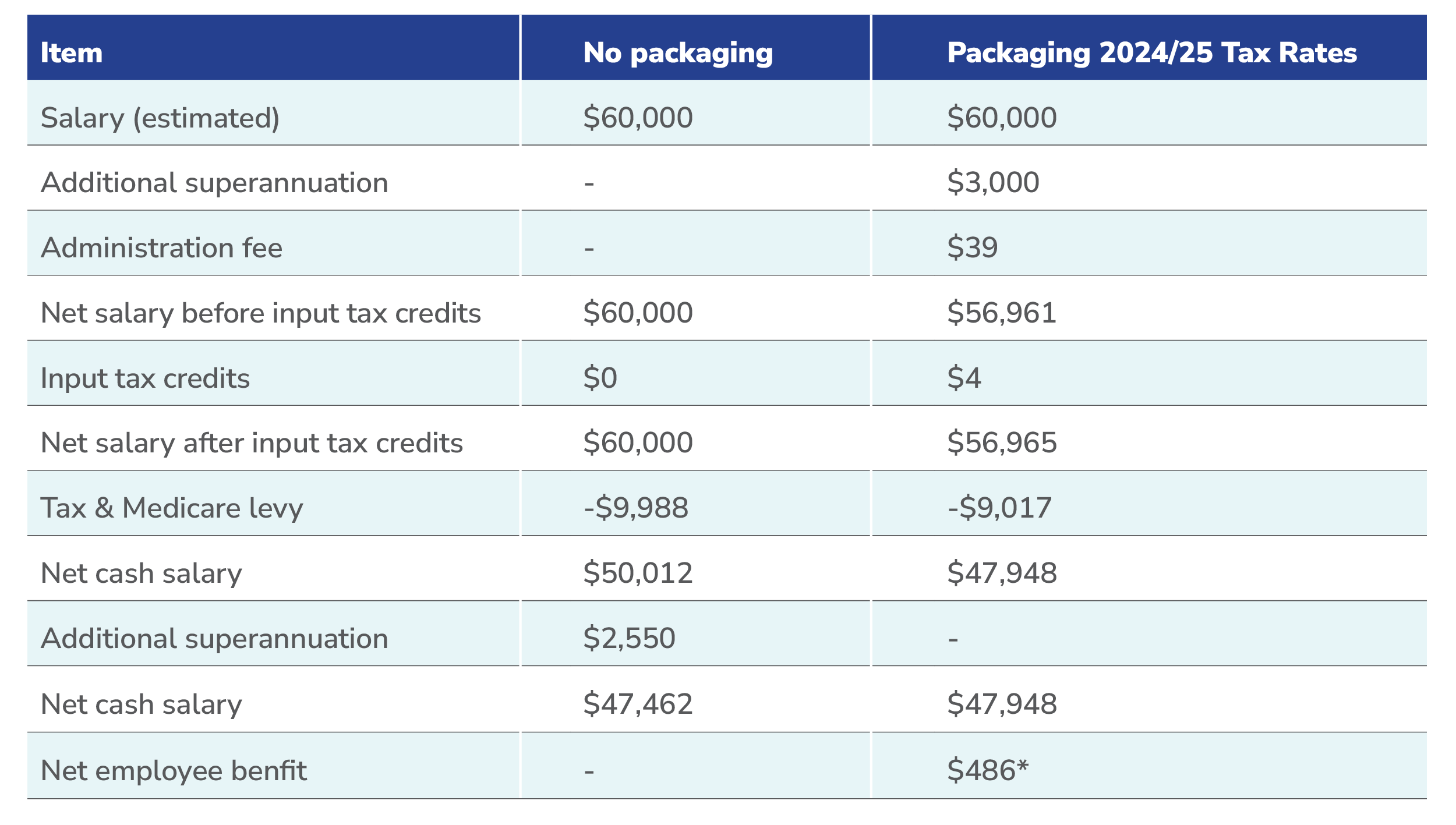

Potential financial benefit on travel costs. Annual salary $60,000

5% Super Contribution: $3000

For more information on this benefit, click here to view the FBT Exempt Benefit Items Fact Sheet and Superannuation Information Booklet.

Ready to get started?

Our online sign-up for super has five steps - and all you need is your employee number (as detailed on your payslip)

Employees can salary package both standard and any additional voluntary superannuation contributions.

The salary packaging of standard and voluntary superannuation contributions can be made only to a regulated superannuation fund that has a complying status.

All superannuation contribution funds are sent directly to the employee’s chosen Super fund.

Disclaimer

Salary Packaging: The estimated potential tax benefit is based on the assumption that an eligible employee salary packages an additional $3,000 towards their superannuation contributions using their pre-tax salary. The additional contribution is subject to the concessional tax rate of 15%. FBT rates effective 1 July 2024 and PAYG tax rates effective 1 July 2024 have been used and average fees and charges are included. The actual administration fee that applies to you may vary depending on your employer. Tax, benefit and Medicare Levy calculations are approximate, and assume no other taxable income is received. HELP repayments and taxation surcharges are excluded.

Superannuation pre-tax contributions shown in the calculations will have concessional contribution tax of 15%. Therefore, the post-tax contribution has also been reduced by 15% to show a more accurate comparison.

This general information doesn’t take your personal circumstances into account. RemServ strongly recommends that before you make any decision on a salary packaging product, you obtain your own independent specialist professional advice including financial advice and personal taxation advice from a licensed tax adviser on your particular circumstances. Conditions and fees apply. The availability of benefits is subject to your employer’s approval. RemServ may receive commissions in connection with its services. For further information, please visit our website at remserv.com.au.

Important Information: Salary packaging is only available to eligible employees of the Queensland Government as per the Standing Offer Arrangement QGP0065-21. The implications of salary packaging for you (including tax savings and impacts on benefits, surcharges, levies and/or other entitlements) will depend on your individual circumstances. The information in this publication has been prepared by Remuneration Services (Qld) Pty Ltd for general information purposes only, without taking into consideration any individual circumstances. Remuneration Services (Qld) Pty Ltd and the Queensland Government recommend that before acting on any information or entering into a salary packaging arrangement and/or a participation agreement with your employer, you should consider your objectives, financial situation and needs, and, take the appropriate legal, financial or other professional advice based upon your own particular circumstances. You should also read the Salary Packaging Participation Agreement and the relevant Queensland Government Salary Packaging Information Booklets and Fact Forms available via the Queensland Government Contracts Directory. The Queensland Government strongly recommends that you obtain independent financial advice prior to entering into, or changing the terms of, a salary packaging arrangement.

Remuneration Services (QLD) Pty Ltd | ABN 46 093 173 089